Skift Take

Goodbye double-digit growth? Hotel prices soared post-pandemic, but with inflation cooling and travel normalizing, 2024 poses the question: Can pricing strength hold? We think so.

Last week, Skift Research published our Global Travel Outlook. The main takeaway was that 2024 will be a year of normalization.

Inflation is slowing and we’re moving away from post-Covid splurging. The big question in the hotel industry remains: Will pricing strength continue this year?

We answer this question in detail in this free Skift Research report. Click here to download. Price gains may slow from the double-digit gains we’ve seen, but on an absolute level, we believe prices will keep rising. There are three key reasons, as seen in the following charts:

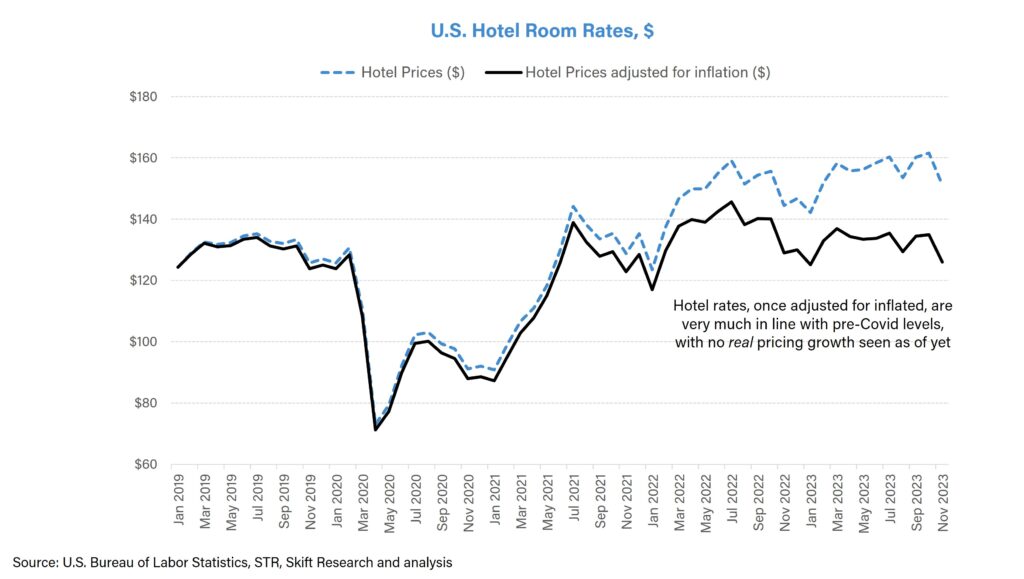

Hotel prices haven’t yet displayed any real pricing strength above inflation

Hotel rates have risen 20% above 2019 levels in the U.S. But that doesn’t take inflation into account. Make that adjustment, and rates are in line with pre-Covid levels – i.e. hotel prices haven’t seen any real growth.

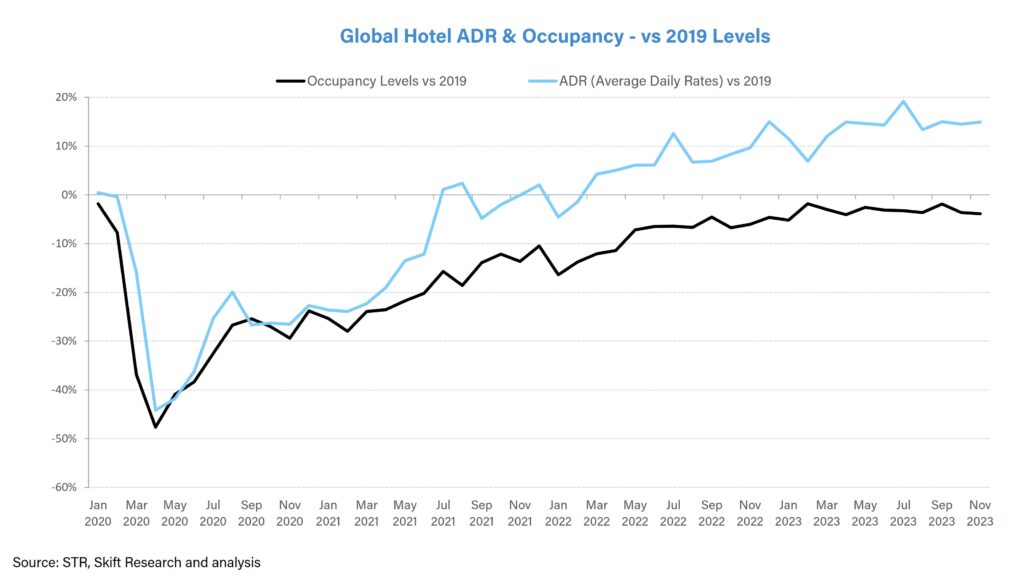

Occupancy levels have not recovered to pre-Covid levels, with occupancy growth aiding RevPAR growth

Normally occupancy growth and ADR (Average Daily Rates) growth move in sync with each other. The period through the Covid pandemic proved to be an exception. As we wrote last year in Recession Watch: Hotel Chain Scale Analysis 2023, the Covid recovery has seen ADRs lead occupancy.

As we enter a more normalized post-Covid world, we should again see a more balanced recovery between occupancy and ADRs.

As shown in the chart below, in 2022 and 2023, global ADRs were above pre-pandemic levels, but occupancy levels still below, meaning that there is still scope for demand recovery in 2024 – and with that comes further RevPAR growth. This is especially true in times of greater demand growth over supply growth, with excess demand resulting as both increased occupancy and increased ADR. Both contribute positively to RevPAR growth.

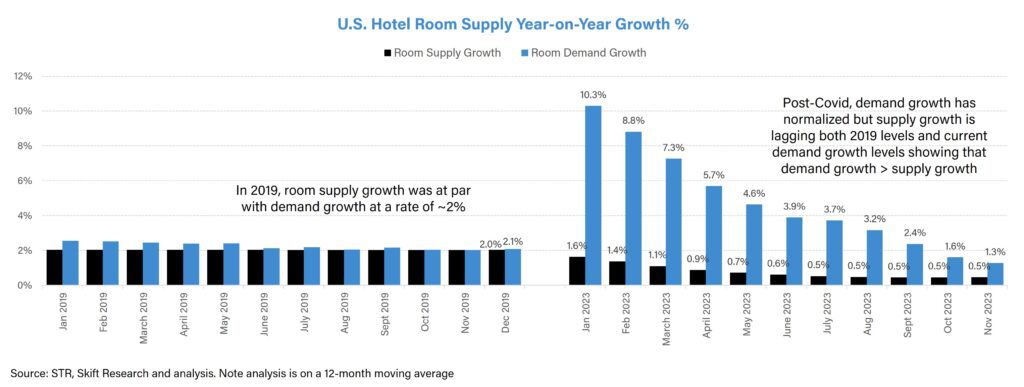

Supply growth continues to be more constrained than demand growth thus aiding hotel pricing power

While U.S. demand growth has normalized throughout 2023, at 1.3% growth as of November 2023, it still leads supply growth of only 0.5%. Hotel supply continues to be constrained in the U.S. post pandemic, held back by high construction costs and high interest rates in a tough financing environment. Low levels of supply in the U.S. market, met by strong and robust demand amidst a high inflationary environment all contribute to strong ADR growth rates.

In conclusion, while 2023 saw hotel growth rates plateauing after more than three years of double-digit pricing growth, 2024 isn’t likely to see flat or declining hotel pricing. Despite moderating inflation and demand normalization, two crucial factors ensure further, albeit slower, price climbs: occupancy rates still haven’t fully rebounded from the pandemic dip, and demand growth continues to outpace constrained supply with excess demand manifesting as real ADR growth.

While double-digit growth may become a relic of the past, we expect that prices will continue rising in 2024, displaying real growth above inflation.

Click here to download the full report for free, as well as our Skift Research Global Travel Outlook 2024 for further sector-specific analysis on trends in the travel industry in 2024.