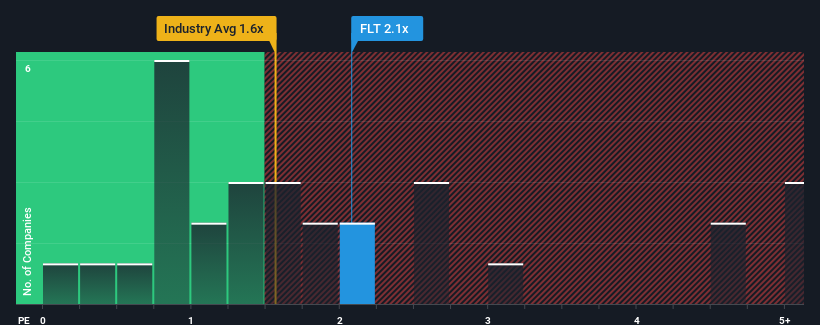

When close to half the companies in the Hospitality industry in Australia have price-to-sales ratios (or “P/S”) below 1.6x, you may consider Flight Centre Travel Group Limited (ASX:FLT) as a stock to potentially avoid with its 2.1x P/S ratio. Nonetheless, we’d need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Flight Centre Travel Group

What Does Flight Centre Travel Group’s Recent Performance Look Like?

With revenue growth that’s superior to most other companies of late, Flight Centre Travel Group has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You’d really hope so, otherwise you’re paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Flight Centre Travel Group’s future stacks up against the industry? In that case, our free report is a great place to start.

Is There Enough Revenue Growth Forecasted For Flight Centre Travel Group?

In order to justify its P/S ratio, Flight Centre Travel Group would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered an exceptional 126% gain to the company’s top line. Revenue has also lifted 20% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 13% per year during the coming three years according to the analysts following the company. That’s shaping up to be materially higher than the 9.1% each year growth forecast for the broader industry.

In light of this, it’s understandable that Flight Centre Travel Group’s P/S sits above the majority of other companies. Apparently shareholders aren’t keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

While the price-to-sales ratio shouldn’t be the defining factor in whether you buy a stock or not, it’s quite a capable barometer of revenue expectations.

As we suspected, our examination of Flight Centre Travel Group’s analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren’t under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

There are also other vital risk factors to consider before investing and we’ve discovered 2 warning signs for Flight Centre Travel Group that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we’re helping make it simple.

Find out whether Flight Centre Travel Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.